Mobilenews24x7 Bureau

The BJP is devoting all its strength for the election was reflected on Monday when two Union ministers and battery of its leaders to repeat what is achieved in the recently concluded Dhamnagar by-poll.

The win in Dhamnagar where the BJP’s Suryabanshi Suraj polled 80,351 votes against BJD candidate Abanti Das’s 70,470, has infused a fresh lease of life in the BJP camp.

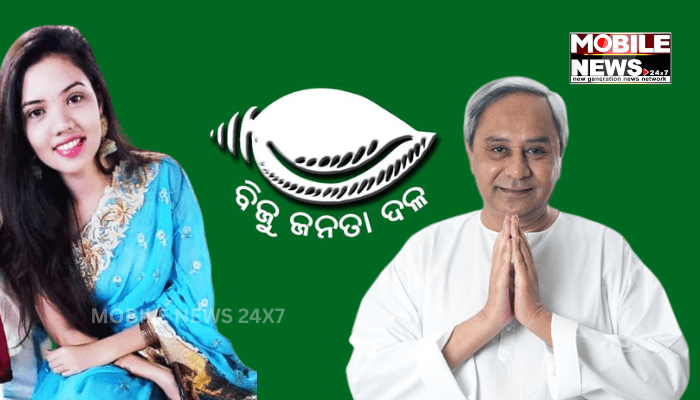

BJD Known For Electoral Authority

But, the BJD is known for its electoral control in the state, having not lost a single by-election in the state since 2008 and an Assembly election since 2000, except the aberration in Dhamnagar where the image of the deceased MLA, Bishnu Prasad Sethy weighed a bit on the side of the saffron.

But, with the expected campaign by the chief minister and the BJD supremo Naveen Patnaik sometime in a few days, political observers hold the view that, that can change the entire electoral chemistry in Padampur and tilt the balance towards the BJD despite a high-octane campaign by the rivals.

So, the final poster is yet to be out in the ongoing campaign there.

Repeat mention of the farmers’ issue, it is supposed in some quarters, may not impact the polling on December 5. With what, perhaps, all the parties kicked off the nominations.

Late Bijay Singh Bariah’s daughter, Barsha Singh Bariah a educated lady with a degree in law, is in the fray from the BJD side taking on Pradip Purohit from the BJP. It is a different matter that, some people had the view that, late Bariah’s wife could have augured well for the BJD.

After all, it is the image of the BJD supremo Naveen Patnaik that many and many of the voters would like to look up to.

The Congress has fielded Satya Bhusan Sahu, a three-time former MLA from the constituency and Sahu, with his locus standi as a politician should not be read so economically. He may honey-comb votes of either the two sides.