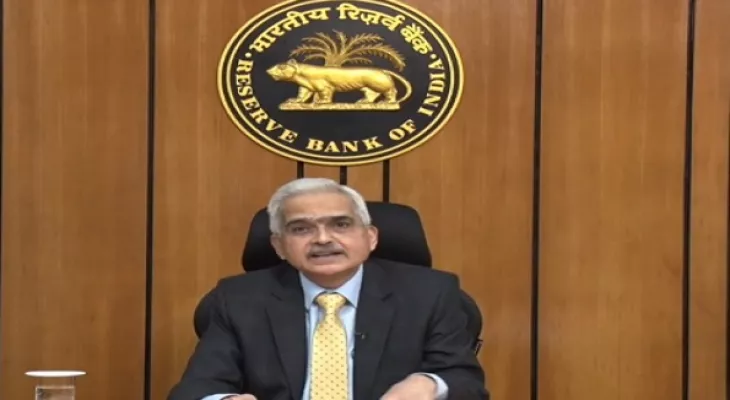

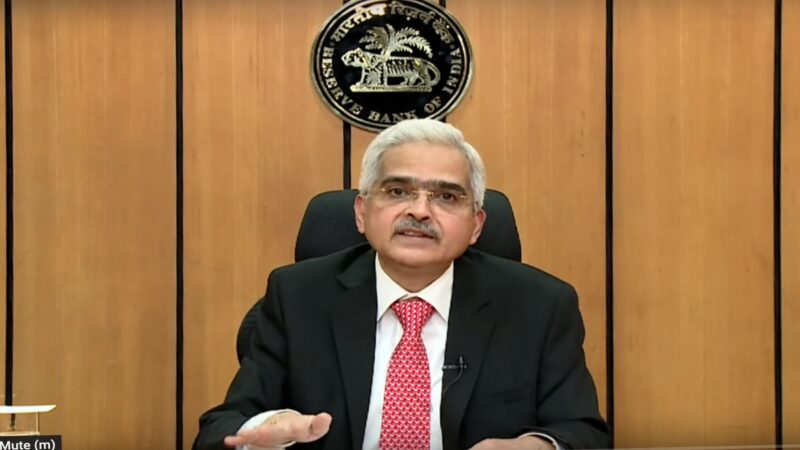

Crypto Threat To Macroeconomic, Financial Stability: RBI Guv

Mumbai, Feb 10: Reiterating his strong views on private cryptocurrency, RBI Governor Shaktikanta Das on Thursday said that cryptocurrencies are a “big threat” to macroeconomic stability and financial stability. “Our position is very clear that private cryptocurrencies or whatever you name it, is a big threat to our macroeconomic stability and financial stability,” Das told reporters adding, “they undermine the RBI’s ability to deal with issues related to financial stability.

” The comments come at a time when Finance Minister Nirmala Sitharaman has announced levying 30 per cent tax on income from the transfer of any virtual digital assets, spreading cheer among the Indian crypto industry. Cautioning the investors who are investing heavily in cryptocurrencies, Das said, “It is my duty to tell those investors who are investing in cryptocurrencies that they should bear in mind that they are investing at their own risk. They should also keep in mind that in cryptocurrencies, there is no underline nor even a tulip.” He noted that the RBI is also cautiously and carefully taking steps in the process of introducing Central Bank Digital Currency (CBDC).

“We are cautiously moving forward (in introducing CBDC). This is one area where we should not do anything in haste. “We are carefully and cautiously examining and moving ahead, because there are many risks associated with it. One of the biggest risks is cyber security and the possibility of counterfeiting,” the Governor said. He noted that all the central banks across the world which are introducing digital currencies are cautious. When asked about the timelines to launch CBDC, Das said, “I would not like to give the timelines. There is an announcement made in the Budget and we are moving forward on those lines.” Sitharaman during her Budget speech, said the digital rupee will be introduced in 2022-23. RBI Deputy Governor T Rabi Shankar told reporters that the central bank has been working on CBDC since the last two years and the work is in progress.

“In the Budget (2023), it has been proposed that the RBI Act will be amended to enable the issue of CBDCs. Once that happens we will pilot or proofs of concept will be tried. Design features or the technological choices will be tested through proofs of concept and as mentioned in the budget we will introduce it.”