Apple introduces Pay Later service

Apple has introduced its Pay Later service in the US which allows users to split purchases into four payments with zero interest and no fees.

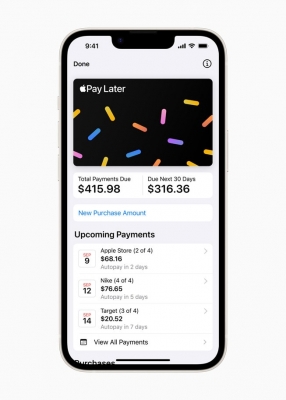

“Users can easily track, manage, and repay their Apple Pay Later loans in one convenient location in Apple Wallet,” the tech giant said in a blogpost on Tuesday.

Users can apply for $50 to $1,000 Apple Pay Later loans, which they can use for online and in-app purchases made on their iPhone or iPad at stores that support Apple Pay.

The iPhone maker is inviting select users to access a pre-release version of the Pay Later service, with plans to provide it to all eligible users in the coming months.

“Apple Pay Later was designed with our users’ financial health in mind, so it has no fees and no interest, and can be used and managed within Wallet, making it easier for consumers to make informed and responsible borrowing decisions,” Jennifer Bailey, Apple’s vice president of Apple Pay and Apple Wallet, said.

The transaction and loan information of users using Pay Later will never be shared or sold to third parties for marketing or advertising purposes.

Also, the purchases are authenticated using Face ID, Touch ID or a passcode.

“Apple Pay Later is enabled through the Mastercard Installments program, so merchants that accept Apple Pay do not need to do anything to implement Apple Pay Later for their customers,” the company said.