RBI Proposes To Increase NACH Mandate Limit For TReDS Related Settlements To Rs 3 Crore

New Delhi, Feb 10: In a bid to ease liquidity for MSMEs, the Reserve Bank of India (RBI) on Thursday proposed to increase the National Automated Clearing House (NACH) mandate limit from Rs 1 crore at present to Rs 3 crore for TReDS related settlements.

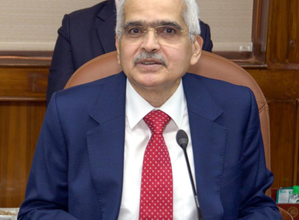

“Keeping in view the requests received from stakeholders and to further enhance the ease of financing the growing liquidity requirements of MSMEs, it is proposed to increase the NACH mandate limit from Rs 1 crore at present to Rs 3 crore for TReDS related settlements,” RBI Governor Shaktikanta Das said while announcing the bi-monthly monetary policy today.

The Trade Receivables Discounting System (TReDS) facilitates the financing of trade receivables of MSMEs. Transactions in TReDS are settled through the NACH system. TReDS is an electronic exchange that allows transparent and online selling of receivables by MSMEs.

In TReDS, the seller gets multiple financiers to choose from, option of various interest rates, and without any collateral helping the seller to get the best deal in transparent manner. The government has taken several measures to promote TReDS by mandating big corporates and public sector companies to register on TReDS.

Based on the current macro economic situation and outlook, the rate-setting panel led by Governor Shaktikanta Das unanimously decided to keep the key policy repo rate unchanged at 4 per cent. The MPC also decided by a majority of 5 to 1 to continue with the accommodative stance as long as necessary to revive and sustain growth on a durable basis and continue to mitigate the impact of Covid 19 on the economy while ensuring that inflation remains within the target going forward